Indicating the support for the Hong Kong’s Climate Action Plan 2050, the Green and Sustainable Finance Cross-Agency Steering Group has announced that climate-related disclosures aligned with Task Force on Climate-Related Financial Disclosures (TCFD) recommendations will be mandatory no later than 2025. GreenCo recently supported one of its clients, a licensed bank in Hong Kong, to improve its methodology of materiality assessment and effectively identify material climate-related risks and opportunities along with their potential impacts in preparation for the latest ESG Report in alignment with TCFD recommendations.

GreenCo is glad to assist its clients to be well-prepared for the potential enhancements in reporting requirements, such as new standards, by staying aligned with the Stock Exchange of Hong Kong’s guidance in their latest reports. We believe identifying material ESG issues, thus making climate-related disclosures appropriately is vital to reducing carbon emissions and progress towards a carbon-neutral future.

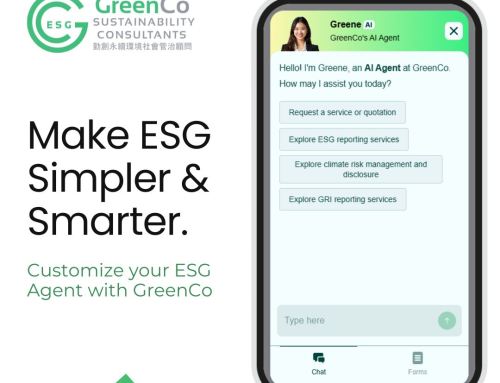

About GreenCo ESG Consulting

GreenCo is a professional ESG advisory firm accredited with ISO 9001 in ESG Reporting and Climate Policy Advisory Services. Established in 2016, we were born to tackle ESG and climate risk management challenges. GreenCo has a professional team consists of talents with multiple backgrounds with

- PhD

- Practitioner Member of the Institute of Environmental Management and Assessment (IEMA)

- CFA (the CFA Institute) and Certificate in ESG Investing

- EFFAS Certified ESG Analyst (CESGA)

- Completion of Certified GRI Training Programme

- Certified Public Accountant (for assurance in accordance with ISAE 3000)

- Member of Global Association of Risk Professionals

- Master’s degree in envirnomental science

GreenCo has solid track record in ESG advisory for over 70 listed companies in Hong Kong, Mainland China, Singapore and Korea, covering all industries under the Hang Seng Industry Classification System.