Upholding the zero-Covid strategy, the Chinese government implemented another round of lockdown of major cities in early 2022. With restricted mobility, companies have been facing challenges in retrieving data for the annual ESG Reporting. To facilitate the affected companies to fulfil their ESG disclosure obligations, GreenCo has proposed a model of reasonable assumptions for one of the most renowned listed bakery companies in China, to facilitate the calculation of environmental data and maximize its compliance with the reporting principles.

We have taken into account the two major factors, namely the number of employees and the production volume, which are highly correlated to the company’s environmental performance. We have categorized the environmental KPIs on a basis of production-related variants and labor-related variants to calculate the environmental data. In such a way, the company can report its environmental performance with a higher reliability and promote a relatively fair comparison on the environmental performance over the years.

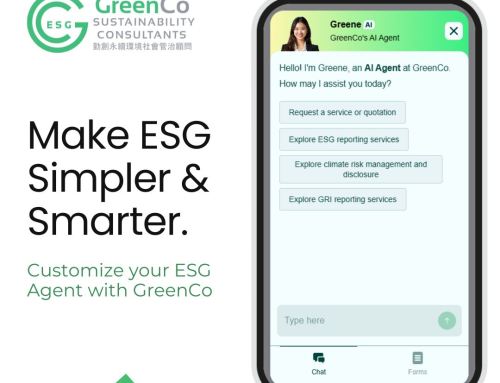

About GreenCo ESG Consulting

GreenCo is a professional ESG advisory firm accredited with ISO 9001 in ESG Reporting and Climate Policy Advisory Services. Established in 2016, we were born to tackle ESG and climate risk management challenges. GreenCo has a professional team consists of talents with multiple backgrounds with

- PhD

- Practitioner Member of the Institute of Environmental Management and Assessment (IEMA)

- CFA (the CFA Institute) and Certificate in ESG Investing

- EFFAS Certified ESG Analyst (CESGA)

- Completion of Certified GRI Training Programme

- Certified Public Accountant (for assurance in accordance with ISAE 3000)

- Member of Global Association of Risk Professionals

- Master’s degree in envirnomental science

GreenCo has solid track record in ESG advisory for over 70 listed companies in Hong Kong, Mainland China, Singapore and Korea, covering all industries under the Hang Seng Industry Classification System.