Recently, the levels of greenhouse gases in the atmosphere reached 415ppm according to the measurement by the National Oceanic and Atmospheric Administration of the United States, reaching back 800,000 years. Under this era of global warming, Hong Kong has inevitable responsibility for slowing down the trend and reducing carbon emissions. In the rapidly growing market of Environmental, Social and Governance (“ESG”) investment, Hong Kong commenced upon ESG industry later than its competitors, such as London and Singapore, but is now proceeding with determination.

In 2013, HKEx published the introduction of the Guide on ESG, and subsequently upgraded the Guide’s reporting obligation to “Comply or explain” in 2016. These measures significantly moved the dial for Hong Kong issuers’ ESG reporting. The Guide was organized into subject areas with various aspects. Further general disclosures and key performance indicators were set out under each aspect. In 2018, after two years of the upgrade of ESG Guide, HKEx conducted two reviews of the ESG report in the market in May and November respectively, and published recommendations on the improvements, mainly including:

Here are some examples highlighting the problems that appeared in the published ESG reports:

From the reviews, the current ESG Guide cannot fully fulfill investors’ and stakeholders’ expectations. Moreover, it is considered crucially important for issuers to have in place a governance structure for ESG management according to international standards and guidance. It is essential for ESG matters to be led and supervised by the board so as to ensure that ESG issues are factored into the high-level discussion, and implemented in appropriate systems and processes with adequate resources being allocated.

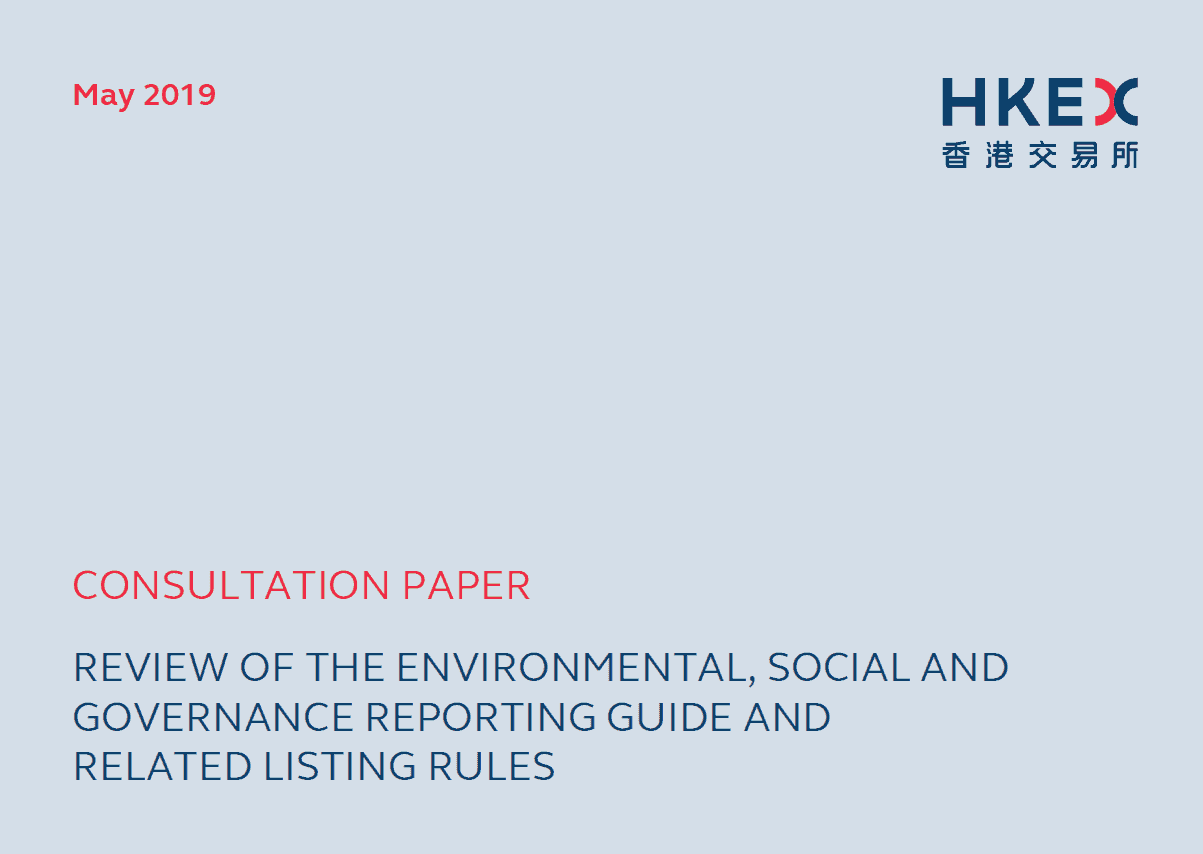

Earlier this year, HKEx has published the consultation paper amending the reporting Guide with reference to Task force on Climate-related Financial Disclosures (‘TCFD’), in order to meet investors’ and stakeholders’ expectations and to facilitate the inclusion of additional core elements in the ESG report. In the consultation paper, HKEx updated Guidance Letter, requiring publishers to set out the expected disclosure on ESG matters and requiring disclosures on gender diversity in the listing documents of new applicants.

As for the amendments in the ESG Guide, HKEx has proposed 5 main changes, including:

-

Introducing Mandatory Disclosure Requirements (MDR);

-

Introducing New Aspect on Climate Change and Revising the Environmental KPIs;

-

Upgrading the Disclosure Obligation of the Social KPIs;

-

Revising the Social KPIs; and

-

Encouraging Independent Assurance.

These proposed amendments were based on the HKEx referencing the latest international developments in ESG reporting industry, especially the TCFD. Disclosures under the TCFD Recommendations are divided into four thematic areas:

-

Governance – the company’s governance around climate-related risks and opportunities.

-

Strategy – the actual and potential impacts of climate-related risks and opportunities on the company’s businesses, strategy, and financial planning where such information is material.

-

Risk Management – how the organization identifies, assesses, and manages climate-related risks.

-

Metrics and Targets – the metrics and targets used to assess and manage relevant climate-related risks and opportunities where such information is material.

To be continued……

Reference:

[1] Consultation Paper: https://www.hkex.com.hk/-/media/HKEX-Market/News/Market-Consultations/2016-Present/May-2019-Review-of-ESG-Guide/Consultation-Paper/cp201905.pdf

[2] TCFD Recommendations: https://www.fsb-tcfd.org/wp-content/uploads/2017/06/FINAL-2017-TCFD-Report-11052018.pdf

[3] Analysis of Environment, Social and Governance Practice Disclosure in 2016/2017: https://www.hkex.com.hk/-/media/HKEX-Market/Listing/Rules-and-Guidance/Other-Resources/Exchanges-Review-of-Issuers-Annual-Disclosure/ESG-Guide/esgreport_2016_2017.pdf?la=en

[4] A STEP-BY-STEP GUIDE TO ESG REPORTING: https://www.hkex.com.hk/-/media/HKEX-Market/Listing/Rules-and-Guidance/Other-Resources/Listed-Issuers/Environmental-Social-and-Governance/How-to-Prepare-an-ESG-Report/steps.pdf?la=en