Benchmarking, in business, is an important process in which an enterprise conducts a comparison of its products, services, development strategies, asset management and any realm with those that excel in the industry. An objective, accurate and oriented benchmarking approach acts as an auxiliary arsenal of resources that the enterprise possesses to enhance their ESG performance and engagement. What is more, it is widely acknowledged as the foundation to create more value for both investors and companies as well. In other words, an effective benchmarking process not only assists investors to better identify environmental, social and governance (ESG) risks and opportunities within their portfolio, but also gives the company a full picture of the missing and leading ESG components compared with its peers in various scales. In the contemporary ESG market, an increasing number of institutional investors, financial organisations, executive officers, and other stakeholders are craving and relying on such rating analysis in different ways to measure and evaluate corporate ESG performance over time and as compared to their competitors. A great many third-party organisations such as Bloomberg, ISS and MSCI, therefore, have developed their various ESG indexes and methodologies for benchmarking.

To provide listed companies in Hong Kong an intuitive grasp of the difference from their peers, a baseline for measuring progress in enhancing high-quality disclosures, and valuable information for future planning, GCESG has launched a project of ESG Reporting Scoring Analysis in 2018, covering approximately 100 companies across all 11 industries according to Hang Seng Industry Classification System (HSICS). Given the size, market capitalisation and sector of each company, sample enterprises in the project were split into four categories (Large-cap, Mid-cap, Small-cap and GEM) to ensure a true reflection of the landscape of HKEx listed companies.

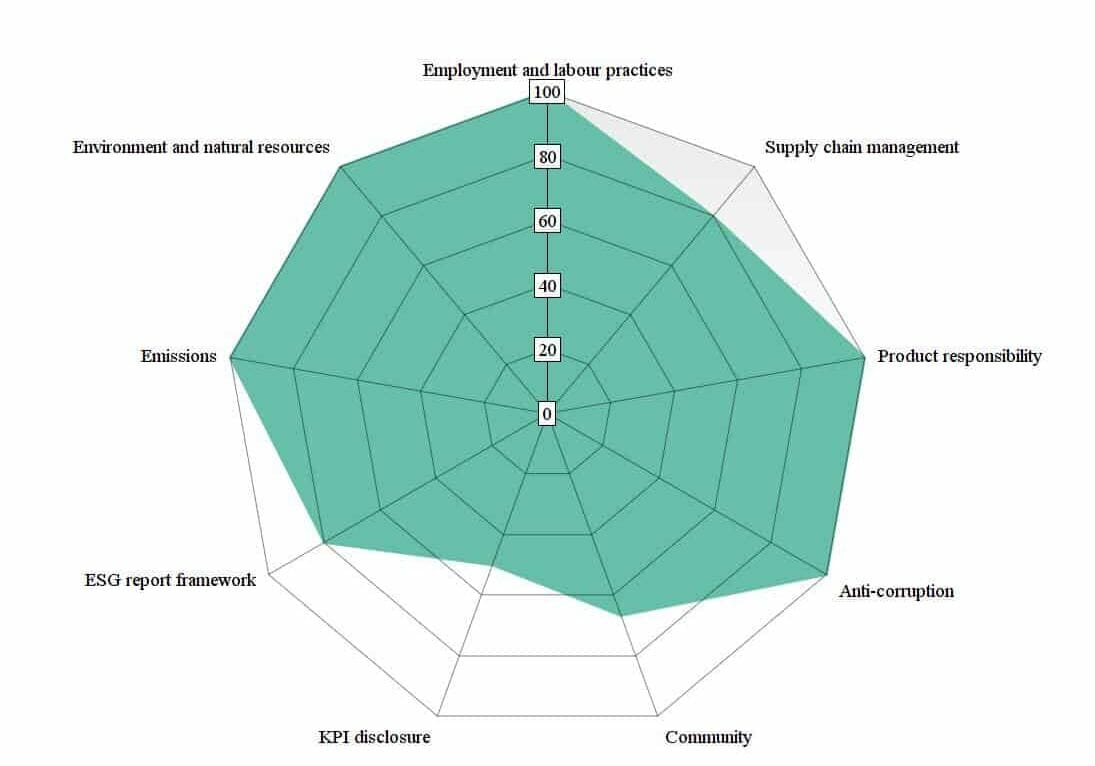

By delving into the ESG reports/Sustainability reports in 2017 of sample companies, GCESG evaluated each company’s ESG reporting performance on a scale of zero to one hundred in terms of the following 9 areas – ESG report framework, emissions, environmental and natural resources, employment and labour practices, supply chain management, product responsibility, anti-corruption, community, and KPI disclosure in a consistent manner. The score of each company was presented in the form of Radar Chart, a graphical method of displaying multivariate data in a two-dimensional chart of several quantitative variables represented on axes starting from the same point. Such Radar Diagram Comparison method is visually helpful for companies and decision-makers to benchmark themselves against their peer group and the entire market practice.

With the method and outcome of this scoring analysis, GCESG has acquired more thought-provoking insights on the status quo of current ESG reporting market and how the ESG reporting system should develop in the near future. More importantly, by incorporating this Radar Chart analysis into general ESG reporting and introducing such benchmarking tool to the market, GCESG expects to provide listed companies with an explicit and precise self-recognition of their reporting quality compared with others, which to some extent will make for an unbiased and omnibearing perception of how to deliver an integrated ESG report in accordance with both the market demand and regulatory requirements for companies.