Define report content: materiality analysis

According to the GRI standards, the sustainability report shall cover topics that: Reflect the reporting organisation’s significant economic, environmental, and social impacts; or Substantively influence the assessments and decisions of stakeholders. Materiality assessment helps the reporting entity to identify [...]

GRI report content: stakeholder engagement

Stakeholder engagement, as a method to obtain stakeholder’s opinions and focus areas, is an essential part of preparing the sustainability report under the GRI framework, which could assist companies to establish the sustainability strategies that suit own development models [...]

What is GRI standard and why should we use GRI standard as a framework for the preparation of ESG reports?

GRI standards provide companies with a flexible and future-proof reporting structure, that is, the forward-looking and rigorous approach advocated by GRI ensures its process and topics can always remain up-to-date and relevant.

Notes on the Insightful Guidance from CASS-CSR4.0 (Part 2)

It has been widely recognised that the healthy ESG development, in particular the proliferation of effective ESG reporting among enterprises, is inextricably wrapped up with the value that a quality report can bring about to the stakeholders and of [...]

Notes on the Insightful Guidance from CASS-CSR4.0 (Part 1)

With a long history of trade, rapid urbanisation, dramatic economic growth, transformative social upheaval, earthshaking alteration of people's perceived value, and certainly the implementation of the Belt and Road Initiative and development of green finance framework, China has an [...]

Will the Consultation Paper of the ESG Reporting Guide be implemented successfully?

The Hong Kong Exchangs (HKEx) published a consultation paper of the ESG Reporting Guide in May 2019, mandating all listed companies to strengthen their disclosure of relevant ESG topics further. The public opinions towards such proposed update are widely divergent, among which some large enterprises even oppose the stricter and more transparent information disclosure of corporate environmental, social and governance performance.

GCESG has officially become a member of Global Reporting Initiative (GRI) Community

Recently, GCESG has successfully joined the Global Reporting Initiative (GRI) community, marking another important step GCESG has taken toward internationally standardised sustainability reporting.

Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 2)

Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 2)Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 2)

Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 2)

Earlier this year, HKEx has published the consultation paper amending the reporting Guide with reference to Task force on Climate-related Financial Disclosures ('TCFD'), in order to meet investors' and stakeholders' expectations and to facilitate the inclusion of additional core elements in the ESG report. The changes suggested in the consultation paper are listed as below.

Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 1)

Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 1)Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 1)

Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 1)

Earlier this year, HKEx has published the consultation paper amending the reporting Guide with reference to Task force on Climate-related Financial Disclosures ('TCFD'), in order to meet investors' and stakeholders' expectations and to facilitate the inclusion of additional core elements in the ESG report.

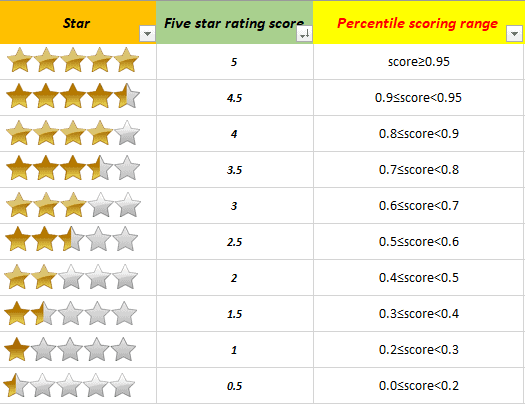

GreenCo ESG Evaluation Methodology – Executive Summary

To satisfy the demands of those stakeholders who necessitate a higher degree of transparency, accuracy and comparability of corporate ESG data, GreenCo provides an effective solution to our customers that allows them to position and benchmark their ESG levels in the industry more precisely.

From ESG reporting to SDGs mapping – What should enterprises do to reflect the value of Sustainable Development Goals in corporate reports?

结合‘In Focus: Addressing Investor Needs in Business Reporting on the SDGs’, ‘Integrating the SDGs into Corporate Reporting: A Practical Guide (2018)’, ESG reporting review 2018: The journey continues (KPMG),以及近年来香港上市公司ESG报告的发展,本篇文章主要谈谈如何帮助企业在建立ESG管理体系的同时,将联合国可持续发展目标的概念带入企业决策,从而构建一个更全面的报告体系和投资者信息获取媒介。

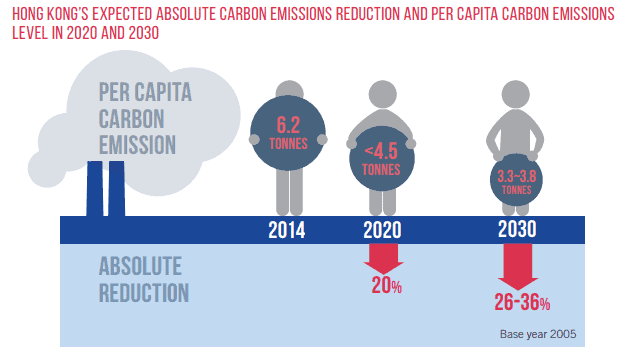

The Analysis of Carbon Intensity on Listed Companies in HK

To provide the right momentum to stimulate a new energy efficiency market where companies keep exploring and making commitment to carbon reduction, GCESG has done a research about the status quo of a wide range of listed companies in Hong Kong in terms of their performance on carbon emissions.

The High Risk of ESG in Food Industry Needs more Attention and Efficient Management

Major suppliers to McDonalds and KFC, including Chinese firm Fujian Sunner and Indian firm Venky’s, are among those graded “high risk”, both in the management of sustainability and in antibiotics stewardship in particular.

The world is moving in the right direction, but in a slow way

The report released by the World Business Council for Sustainable Development (WBCSD) and the Climate Disclosure Standards Board (CDSB), underscores that while sustainability reporting is moving in the right direction, the pace of change needs to accelerate to ensure a prosperous and sustainable future.

Using ESG to help improve investment outcomes

Factor Investing model has become a practical tool in quantitative investing industry.

The whole world starts to invest

As one of the most important strategies of Principle Investment, ESG (Environmental, Social and Governance) has gained more attention from investors recently. It is known that all 234 A-stock companies included in MSCI will receive ESG evaluation shortly. (https://finance.qq.com/a/20180527/015139.htm) [...]

Define report content: materiality analysis

According to the GRI standards, the sustainability report shall cover topics that: Reflect the reporting organisation’s significant economic, environmental, and social impacts; or Substantively influence the assessments and decisions of stakeholders. Materiality assessment helps the reporting entity to identify [...]

GRI report content: stakeholder engagement

Stakeholder engagement, as a method to obtain stakeholder’s opinions and focus areas, is an essential part of preparing the sustainability report under the GRI framework, which could assist companies to establish the sustainability strategies that suit own development models [...]

What is GRI standard and why should we use GRI standard as a framework for the preparation of ESG reports?

GRI standards provide companies with a flexible and future-proof reporting structure, that is, the forward-looking and rigorous approach advocated by GRI ensures its process and topics can always remain up-to-date and relevant.

Notes on the Insightful Guidance from CASS-CSR4.0 (Part 2)

It has been widely recognised that the healthy ESG development, in particular the proliferation of effective ESG reporting among enterprises, is inextricably wrapped up with the value that a quality report can bring about to the stakeholders and of [...]

Notes on the Insightful Guidance from CASS-CSR4.0 (Part 1)

With a long history of trade, rapid urbanisation, dramatic economic growth, transformative social upheaval, earthshaking alteration of people's perceived value, and certainly the implementation of the Belt and Road Initiative and development of green finance framework, China has an [...]

Will the Consultation Paper of the ESG Reporting Guide be implemented successfully?

The Hong Kong Exchangs (HKEx) published a consultation paper of the ESG Reporting Guide in May 2019, mandating all listed companies to strengthen their disclosure of relevant ESG topics further. The public opinions towards such proposed update are widely divergent, among which some large enterprises even oppose the stricter and more transparent information disclosure of corporate environmental, social and governance performance.

GCESG has officially become a member of Global Reporting Initiative (GRI) Community

Recently, GCESG has successfully joined the Global Reporting Initiative (GRI) community, marking another important step GCESG has taken toward internationally standardised sustainability reporting.

Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 2)

Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 2)Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 2)

Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 2)

Earlier this year, HKEx has published the consultation paper amending the reporting Guide with reference to Task force on Climate-related Financial Disclosures ('TCFD'), in order to meet investors' and stakeholders' expectations and to facilitate the inclusion of additional core elements in the ESG report. The changes suggested in the consultation paper are listed as below.

Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 1)

Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 1)Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 1)

Interpretation of the ‘Consultation Paper – Review of The Environmental, Social and Governance Reporting Guide and Related Listing Rules’ released by HKEx (PART 1)

Earlier this year, HKEx has published the consultation paper amending the reporting Guide with reference to Task force on Climate-related Financial Disclosures ('TCFD'), in order to meet investors' and stakeholders' expectations and to facilitate the inclusion of additional core elements in the ESG report.

GreenCo ESG Evaluation Methodology – Executive Summary

To satisfy the demands of those stakeholders who necessitate a higher degree of transparency, accuracy and comparability of corporate ESG data, GreenCo provides an effective solution to our customers that allows them to position and benchmark their ESG levels in the industry more precisely.

From ESG reporting to SDGs mapping – What should enterprises do to reflect the value of Sustainable Development Goals in corporate reports?

结合‘In Focus: Addressing Investor Needs in Business Reporting on the SDGs’, ‘Integrating the SDGs into Corporate Reporting: A Practical Guide (2018)’, ESG reporting review 2018: The journey continues (KPMG),以及近年来香港上市公司ESG报告的发展,本篇文章主要谈谈如何帮助企业在建立ESG管理体系的同时,将联合国可持续发展目标的概念带入企业决策,从而构建一个更全面的报告体系和投资者信息获取媒介。

The Analysis of Carbon Intensity on Listed Companies in HK

To provide the right momentum to stimulate a new energy efficiency market where companies keep exploring and making commitment to carbon reduction, GCESG has done a research about the status quo of a wide range of listed companies in Hong Kong in terms of their performance on carbon emissions.

The High Risk of ESG in Food Industry Needs more Attention and Efficient Management

Major suppliers to McDonalds and KFC, including Chinese firm Fujian Sunner and Indian firm Venky’s, are among those graded “high risk”, both in the management of sustainability and in antibiotics stewardship in particular.

The world is moving in the right direction, but in a slow way

The report released by the World Business Council for Sustainable Development (WBCSD) and the Climate Disclosure Standards Board (CDSB), underscores that while sustainability reporting is moving in the right direction, the pace of change needs to accelerate to ensure a prosperous and sustainable future.

Using ESG to help improve investment outcomes

Factor Investing model has become a practical tool in quantitative investing industry.

The whole world starts to invest

As one of the most important strategies of Principle Investment, ESG (Environmental, Social and Governance) has gained more attention from investors recently. It is known that all 234 A-stock companies included in MSCI will receive ESG evaluation shortly. (https://finance.qq.com/a/20180527/015139.htm) [...]